Our Industry

The business objective of the investment funds industry is a simple one – to deliver investment solutions to help Canadians build wealth. We accomplish our objective by connecting Canada’s savers with Canada’s economy.

The industry facilitates investment for households. 47 per cent of Canadians who have savings or investments own investment funds and investment funds account for half of Canadians’ retirement savings.

The industry is helping reshape Canada’s economy, generating economic activity that contributes significantly to Canada’s GDP and employment for 260,000 Canadians. The Conference Board of Canada estimated that the industry contributed $37 billion, or 1.7%to Canada’s GDP through direct and indirect activity.

The Canadian investment funds industry also provides business capital, currently providing Canadian companies with $370 billion in capitalization in the form of equity and a further $167 billion in funding in the form of corporate bonds.

Mutual funds and ETFs make it possible for ordinary people with small amounts of capital to participate in a professionally managed, diversified porfolios – something that at one time only the wealthy could access. Close to 140 fund management firms in Canada offer more than 4,000 funds, while assets under management continue to grow.

From 1990 to the end of 2019, the amount of money Canadians invested in mutual funds skyrocketed from $100 billion to $1.71 trillion.

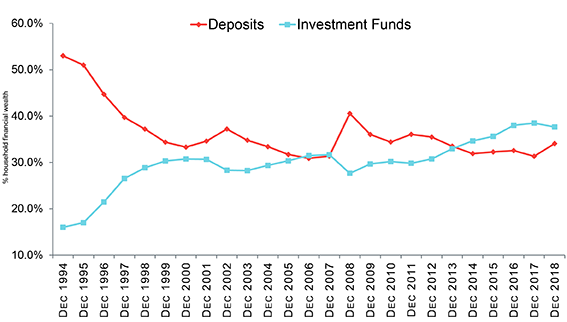

Canadians’ confidence in funds is also reflected in the percentage of household financial assets invested in them. In 2014, Canadians placed more money in investment funds (35 per cent of household financial wealth in mutual funds, ETFs and segregated funds) than in deposits (32 per cent), reflecting the steady growth in confidence that investment funds have experienced over the past two decades. Today, investment funds represent 38% of the household wallet.

The funds industry offers Canadians a wide range of distribution channels and pricing structures, from commission-based to fee-based to do-it-yourself. Approximately 80% of mutual fund investors and 50% of ETF investors make their fund purchases through an advisor. Relative to GDP, Canada has one of the largest fund industries in the world, at 97.8% of national output and one of the largest bases of advisors per capita, with over 110,000 registered advisors.